We provide a full-service suite of investment committee support services

Our services

Data chair access

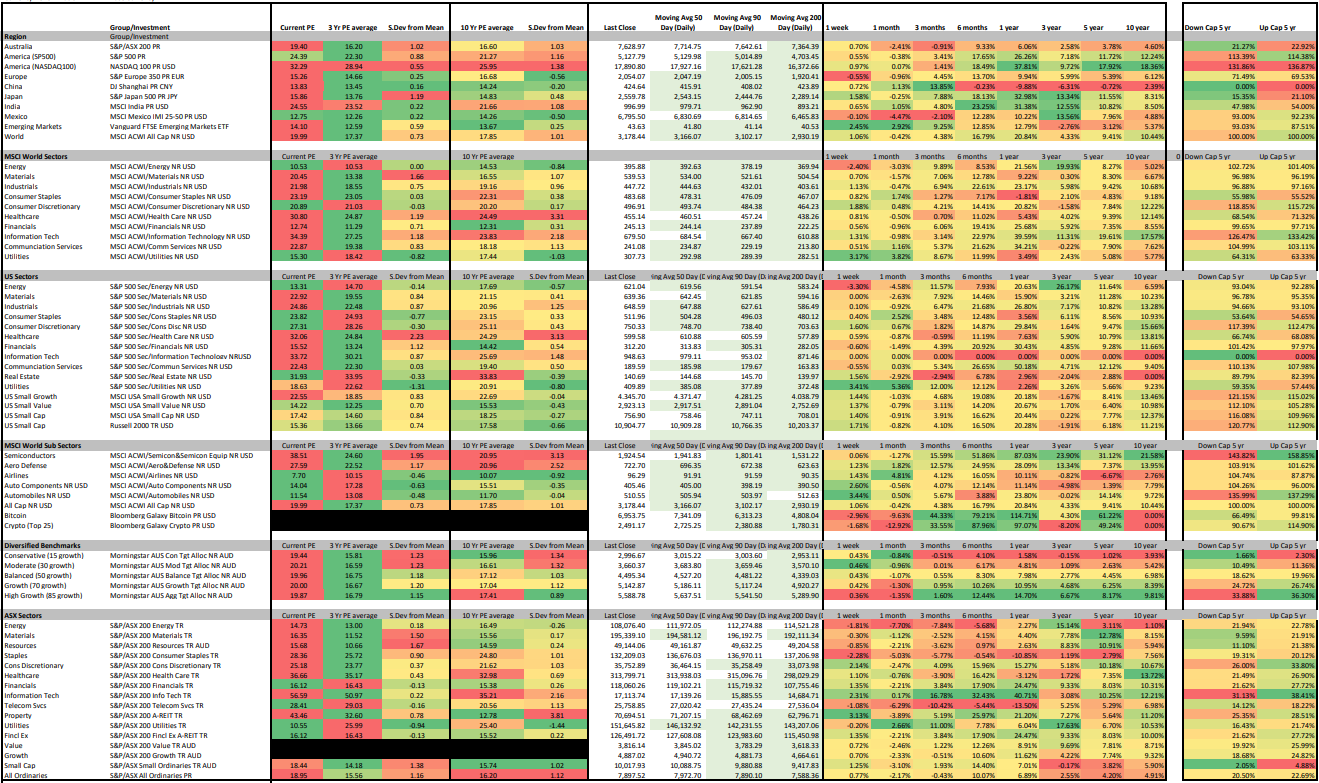

Our service empowers investment committees by harnessing data peerlessly, setting them apart from competitors. In an environment where most committees are constrained by limited and disparate data sources, our solution revolutionises the decision-making process. By leveraging comprehensive and accurate data analytics, investment committees can better comply with tightening regulations and fulfil the increasing requirements for advisers and mandated portfolios. Our service streamlines operations and enhances strategic planning, ensuring that committees remain at the forefront of the investment landscape.

Portfolio Optimisation and Reporting

Our portfolio analysis and optimization service utilizes the robust Morningstar Direct tool to provide comprehensive insights into your investments. By leveraging Morningstar Direct's powerful capabilities, we are able to conduct in-depth evaluations of your portfolio's performance, risk exposure, and diversification levels. Our service aims to identify areas of improvement and recommend strategic changes to optimize your portfolio based on your financial goals and risk tolerance. With the aid of Morningstar Direct, we can offer you data-driven recommendations to enhance the overall performance and stability of your investment portfolio.

Risk Management

At Ikigai Investments, our investment philosophy focuses on creating meaningful asset allocation skews while maintaining rigorous control over risks through detailed portfolio analysis and a clear process to ensure that portfolios align with your client's needs. Our approach involves a comprehensive examination of sector, regional, and factor risks to construct portfolios that are well-positioned to weather market fluctuations and deliver long-term value to our clients. By continuously monitoring and adjusting our investment strategies, we strive to provide tailored solutions that meet the diverse goals and risk tolerances of our clients.

Asset Selection and Allocation

Our process at Ikigai Investments revolves around data-driven asset selection advice, approved product management, and asset allocation strategies. We meticulously analyse market trends, historical data, and financial indicators to provide tailored investment recommendations. Our rigorous research and thorough due diligence ensure our clients receive sound and informed advice that aligns with their financial goals and risk tolerance levels. By combining expertise with advanced analytics, we aim to optimize portfolio performance and deliver value-added insights for successful wealth management.

Bespoke Reporting

At Ikigai Investments, we offer a comprehensive service that delivers client-facing reports for our clients' portfolios. Our reports are designed to track key metrics against the portfolios' benchmarks and peers, providing valuable insights into performance. All in an attractive and clear format. Additionally, we provide bespoke reports that are tailored to our clients' preferences, ensuring they have access to the data they need in a format that suits their specific requirements. With our customized reporting solutions, clients can stay informed and make well-informed decisions about their investments.

“The data we receive regularly from IKIGAI not only help contextualise the discussions we have at our IC meetings, but help set us apart when having discussions with clients”

— J.G , IKIGAI INVESTMENT CLIENT